Tortoise Investing

What is it?

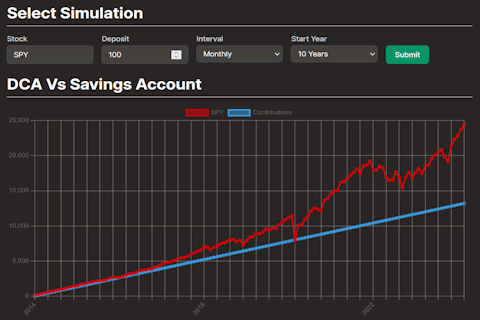

The Tortoise Investing tool was created by a team of myself and

three others during the

GrizzHacks 6 24-hour

hackathon. It was designed to be an educational tool to introduce

the dollar cost averaging investment strategy to an audience of

people who were either new or wary to investing. It accomplishes

this in two ways. First, it explains how the strategy works using

simple terms. Secondly, it gives the user access to an interactive

simulation. This simulation lets you select a stock ticker of

choice, a time period between each investment, and an amount of

money to invest per period time. Then the results are shown in a

graph, comparing how much money the user would have had at any one

point in time should they have followed either the dca strategy, or

put the same amount of money into a savings account.

The Tortoise Investing tool was created by a team of myself and

three others during the

GrizzHacks 6 24-hour

hackathon. It was designed to be an educational tool to introduce

the dollar cost averaging investment strategy to an audience of

people who were either new or wary to investing. It accomplishes

this in two ways. First, it explains how the strategy works using

simple terms. Secondly, it gives the user access to an interactive

simulation. This simulation lets you select a stock ticker of

choice, a time period between each investment, and an amount of

money to invest per period time. Then the results are shown in a

graph, comparing how much money the user would have had at any one

point in time should they have followed either the dca strategy, or

put the same amount of money into a savings account.

Demo

How was it made?

This webapp was made using

NextJS for the

backend/frontend. We also used tailwind for the styling, and

ChartJS for

the chart displays. It works by accessing a yahoo finance api that

provides us with historical stock price data in the csv format. We

then parse this data and simulate the dca investment strategy on the

backend before sending it to the client component containing the

chart on the front end.

This was admittedly a very simple project for a hackathon, but we

intentionally made this decision so we could focus more on UI and

some other events like the CTF that was hosted, which turned out

really well for us.

Tortoise Investing inc. claiming their spoils from the CTF

tournament.

NaveenJohn

(Left), Ashton, 4

Bean Bags (Center),

Jobin, Ryan